📖 Day 5 – Financial Statistics

Rolling Statistics: Moving Average

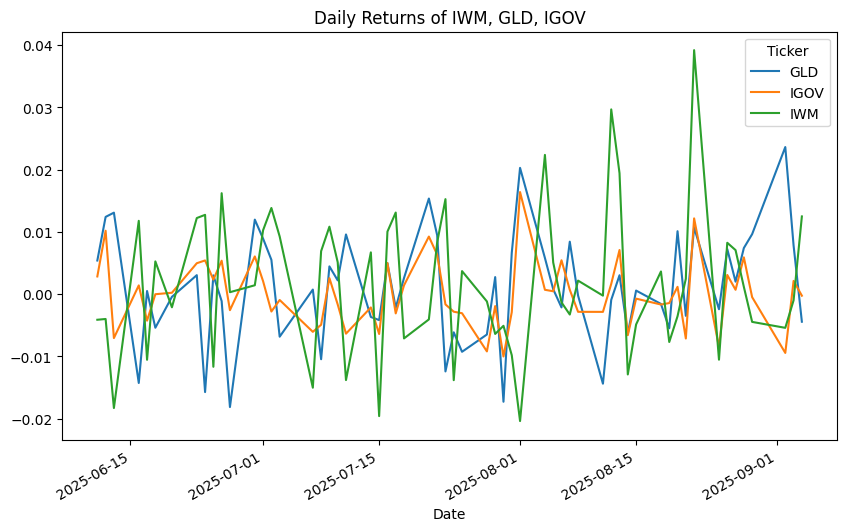

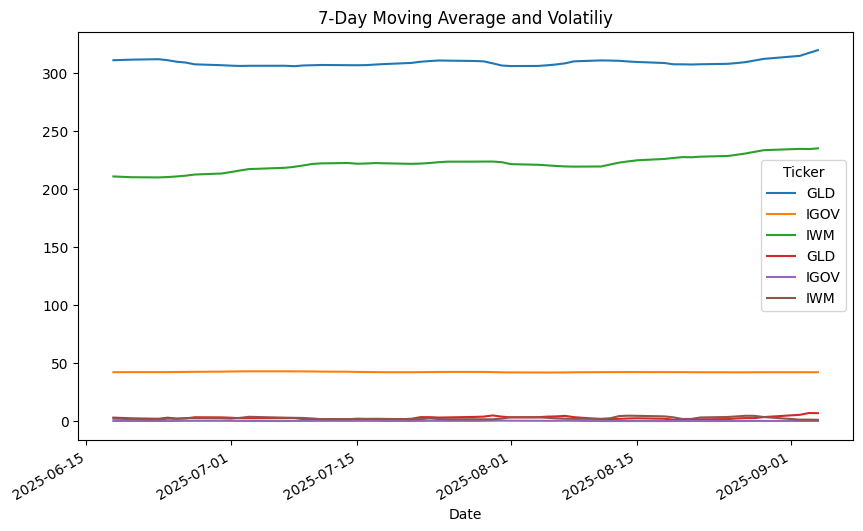

This day I explored rolling statistics in Pandas, applied to financial time series; this lets me smooth data and analyzing volatility trends.

Main Goals:

- Calculate moving averages (in this work 7 days) of closing prices.

- Calculate standard deviation (volatility), so the risk of each asset.

- Plot: first plots of daily returns and rolling metrics

Step by Step

📍 Step 1: Download of data Matrix with assets and volumes as per previous works (closing prices and volumes of IWM, GLD, IGOV).

📍 Step 2: Calculated .pct_change(), 7-day moving average, and rolling std.

📍 Step 3: Plotted returns, moving averages, and volatility together, comparing the performances of each asset.

Challenges / Insights

- Learned how .rolling(window) works.

- Discovered how to layer multiple plots on the same figure (ax=plt.gca()).

- Saw how volatility clusters can appear visually.

Code Snippet

```python returns = close.pct_change().dropna() mov_avg = close.rolling(window=7).mean() std = close.rolling(window=7).std() returns.plot(figsize=(10,6), title="Daily Returns") mov_avg.plot(figsize=(10,6), title="7-Day Moving Average") std.plot(ax=plt.gca()) plt.show() ```

Plots

Next Step

👉 Correlation analysis between assets.